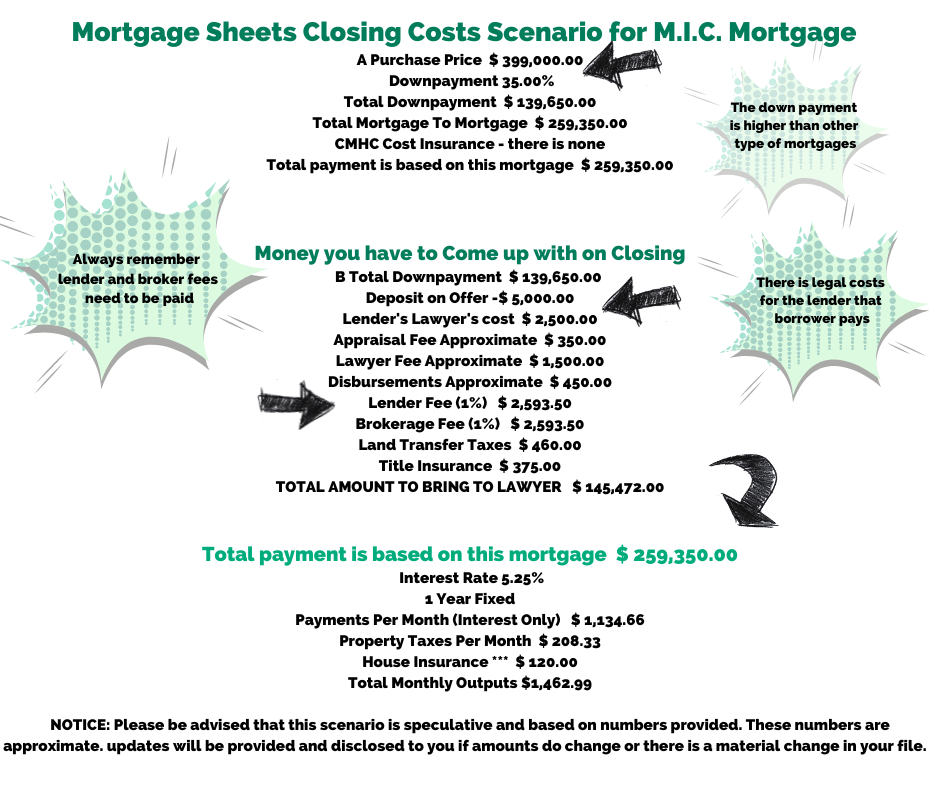

We are going to break down the costs when you are closing your mortgage with a M.I.C. type lender. We can look into what a M.I.C. is, and how they are formed in a later discussion. For now, we will focus on the costs to this borrower type on closing.

The M.I.C. interest rate generally is lower than a private mortgage as the down payment is higher. This higher down payment lowers the overall risk of the file. Terms offered by M.I.C. lenders range from One to Three years. M.I.C. mortgages usually are used in replacement of a mortgage bridge, allowing more flexibility, and pay back terms.