B-Lending is cheaper than Private Lending.

We won’t go into the details of what B Lending Mortgages are all about.

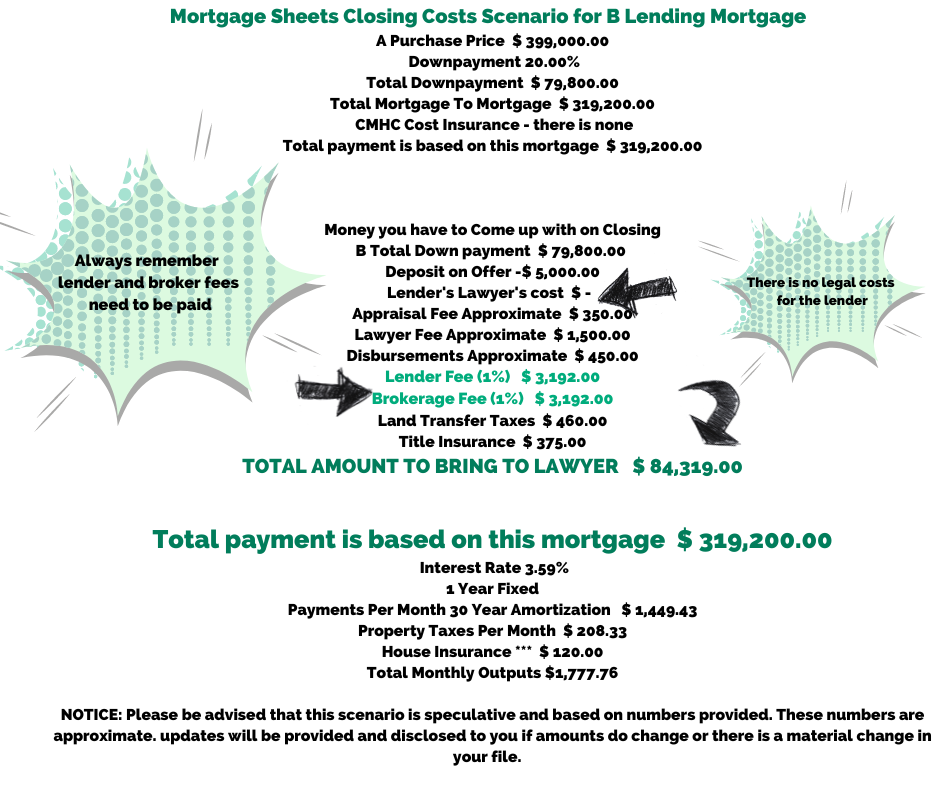

For that, you can go ahead and check out what B lending is. In this post, we will break down the costs of getting into a B Lending Mortgage.

This type of scenario applies only to certain borrower types.

In this B-Lending scenario, the borrower would pay mortgage fees, and there isn’t a big weight put on an exit strategy. Some lenders offer a Graduation Program upon renewal.

The B Lender would assess your creditworthiness upon your one, two, or three-year B Lending term and graduate you to the Triple-A side of the company.

Always talk to an Agent/Broker to discuss your specific situation so we can find you the proper mortgage. Not all mortgages come with mortgage fees. Always know why and how much.