Mortgage Intent To Lend Vs. Mortgage Commitment

In the world of mortgage lending, a mortgage commitment and intent to lend are two very different terms. Understanding this difference is crucial for anyone

In the world of mortgage lending, a mortgage commitment and intent to lend are two very different terms. Understanding this difference is crucial for anyone

We are not talking about a cozy blanket in this post. However, sometimes getting a blanket mortgage can create a cozy deal. A blanket mortgage

Higher quality comes at a cost. Builder upgrades occur when a borrower adds additional features or upgrades their new home above and beyond the original

Custom build homes offer a unique opportunity for homeowners to create a living space that perfectly fits their lifestyle and personal taste. What exactly does

How much of a home can I afford? The answer is your mortgage purchasing power. Understanding this can help you to make more informed decisions

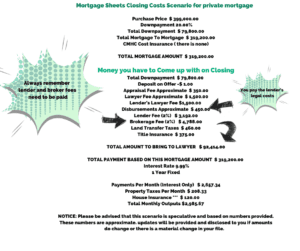

A Private Mortgage is something that looks expensive… because it is. Mortgage Suite breaks down all costs in a list to show you what it

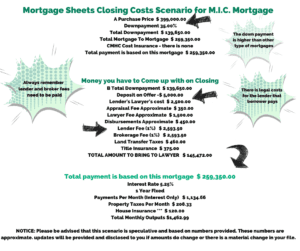

We are going to break down the costs when you are closing your mortgage with a M.I.C. type lender. We can look into what a

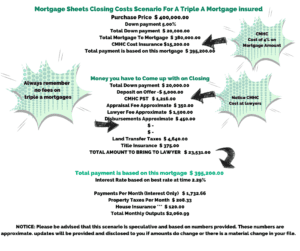

This is the Triple-A Mortgage. There are a few names, bank lending, due to banks historically lending to best credit clients, a borrower, strong covenant.

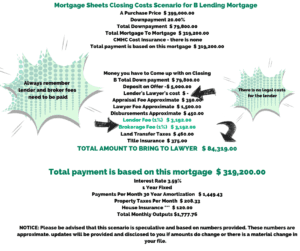

B-Lending is cheaper than Private Lending. We won’t go into the details of what B Lending Mortgages are all about. For that, you can go

Have you ever wondered what a Lender looks at when it comes to giving you a mortgage? And yes, there are specific qualifications and standards.

Join Our Mailing List

Stay connected with expert insights, local market trends, and more valuable tips!

| Thank you for Signing Up |