The Science Behind Joint Tenancy & Tenants In Common

What is Joint Tenancy and how does it differ from Tenants In Common? The Difference Between Joint Tenancy and Tenants in Common is: The structure

What is Joint Tenancy and how does it differ from Tenants In Common? The Difference Between Joint Tenancy and Tenants in Common is: The structure

There are many costs when it comes to refinancing your mortgage. Most of these costs are realized at the end when you sign with a

We all know we need a down-payment for a mortgage. This shows the lender you are serious and have “skin in the game”. All this

A vendor take back is the process where a seller of a home takes back a portion of the equity as a mortgage loan. V.T.B.s

Higher quality comes at a cost. Builder upgrades occur when a borrower adds additional features or upgrades their new home above and beyond the original

Custom build homes offer a unique opportunity for homeowners to create a living space that perfectly fits their lifestyle and personal taste. What exactly does

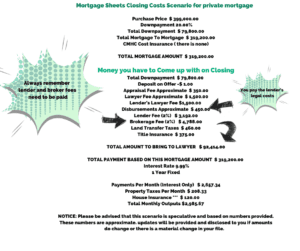

A Private Mortgage is something that looks expensive… because it is. Mortgage Suite breaks down all costs in a list to show you what it

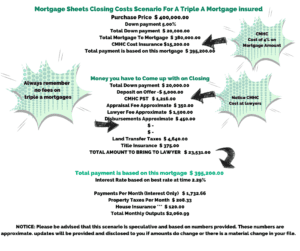

This is the Triple-A Mortgage. There are a few names, bank lending, due to banks historically lending to best credit clients, a borrower, strong covenant.

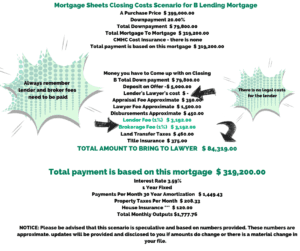

B-Lending is cheaper than Private Lending. We won’t go into the details of what B Lending Mortgages are all about. For that, you can go

Now that you want to buy a home it’s time to look at some creative ways to obtain your down payment. Sometimes it makes sense

Join Our Mailing List

Stay connected with expert insights, local market trends, and more valuable tips!

| Thank you for Signing Up |