The Dilemma of Income, Taxes, and Mortgage Rates

Striking the right balance between Income Taxes and Mortgage Rates… In the intricate realm of personal finance, many individuals encounter a crossroads when juggling income,

Striking the right balance between Income Taxes and Mortgage Rates… In the intricate realm of personal finance, many individuals encounter a crossroads when juggling income,

The concept of a weighted average is a fundamental mathematical idea that plays a crucial role in various aspects of finance, economics, and many other

Buying a home is a significant milestone in one’s life, but for many Canadians, the journey toward homeownership can be challenging. Especially when it comes

It’s been a top economic story in Canada in the past year or so. Headlines of “Inflation running rampant”, “Bank of Canada Rate Hike Announcement”,

Home appraisals are an essential part of the mortgage application process. These unbiased and professional evaluations provide crucial insights into a property’s value, acting as

When it comes to homeownership, securing a mortgage is a common practice for many Canadians. However, understanding the various mortgage payment options available is crucial

Purchasing a home is a major life milestone, and planning for a mortgage is a crucial step to making that dream come true. Whether you’re

For many homeowners, a property represents a significant asset that holds a considerable amount of value. One of the key advantages of home ownership is

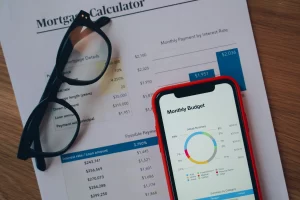

Mortgage rates are one of the most important factors to consider when buying a home. These rates are impacted by factors such as economic indicators,

When you’re in the market for a new home, getting a mortgage is usually a necessary step. But what happens if you don’t have a

Join Our Mailing List

Stay connected with expert insights, local market trends, and more valuable tips!

| Thank you for Signing Up |